Yorbeau Resources Begins an Exploration Program on Its Beschefer Property in Northwestern Québec

Home » news-releases

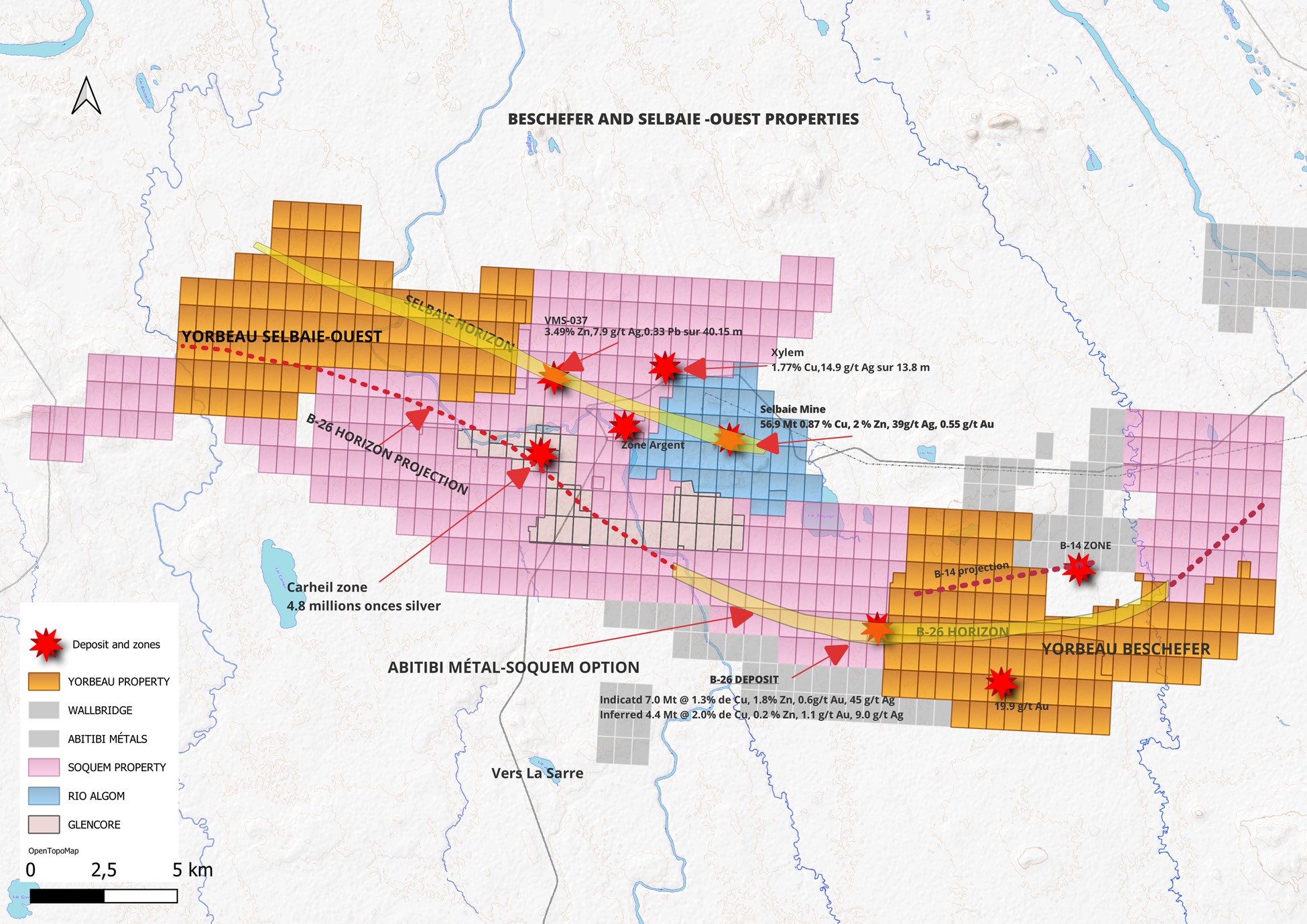

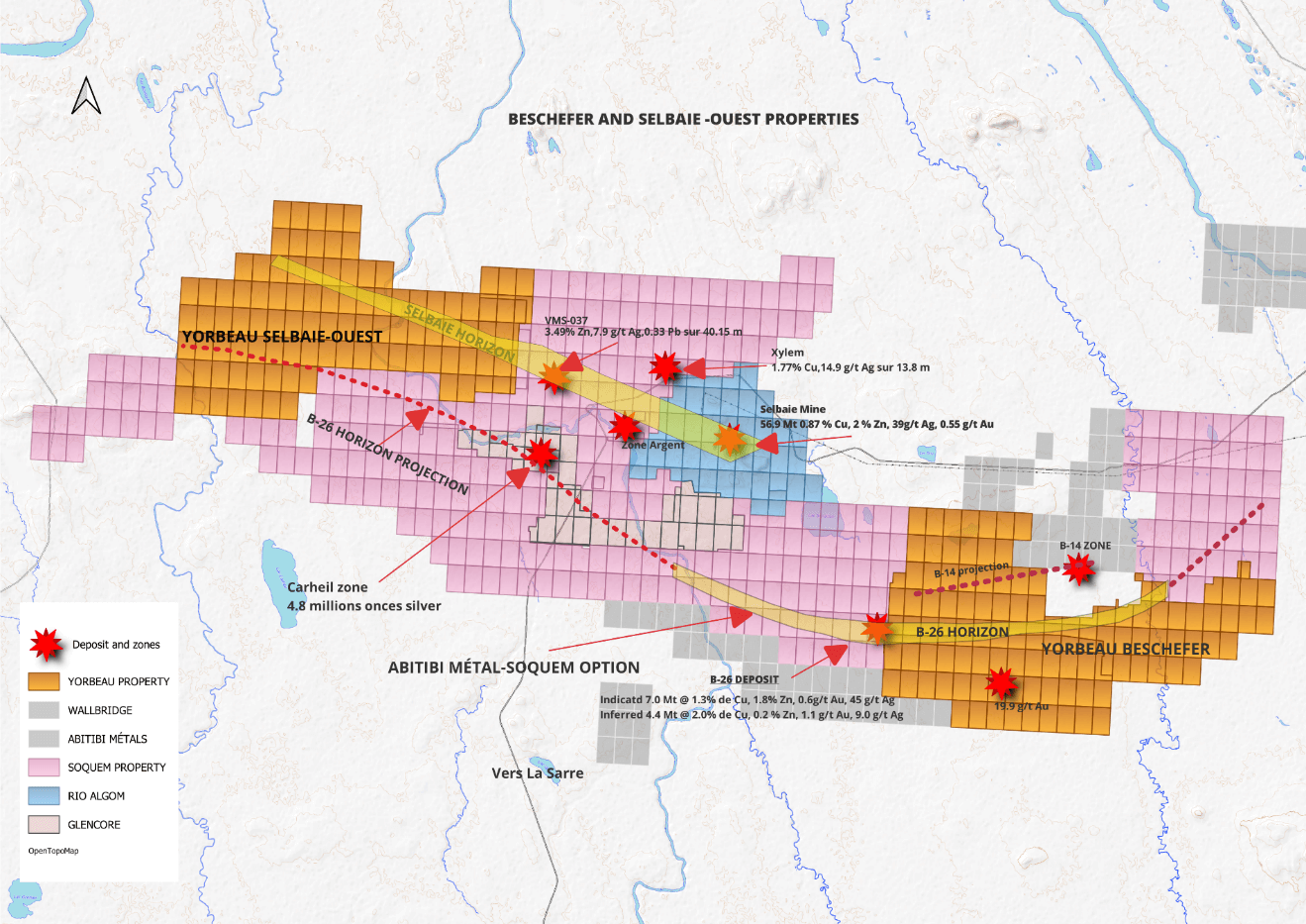

MONTRÉAL, Jan. 22, 2025 - Yorbeau Resources Inc. (TSX: YRB), (“Yorbeau” or the “Company”) has commenced the first phase of its 2025 exploration program in the Selbaie Mine area. This first phase consists of approximately 6,000 metres of drilling on the Beschefer property located 9 km southeast of the former Selbaie producer (56.9 Mt @ 0.87%, Cu 1.85%, Zn 39 g/t Ag) and immediately east of the B-26 Zone currently being developed by Abitibi Metals and Soquem (11.3 MT @ 2.13% Cu Eq (Ind) & 7.2 MT @ 2.21% Cu Eq (Inf)).

The objective of the first phase is to explore the eastward extension of the B-26 Zone to an average depth of approximately 400 metres, as well as providing access for electromagnetic downhole drill surveys. The drilling program will include at least 8 holes (6,000 metres) covering more than 2.6 km along the B-26 horizon, where Yorbeau has already obtained several significant values in copper and zinc between 1999 and 2001 (1.8% copper over 1.5 metres, 0.2% copper and 0.32% zinc over 16 metres, 0.5% copper over 12 metres).

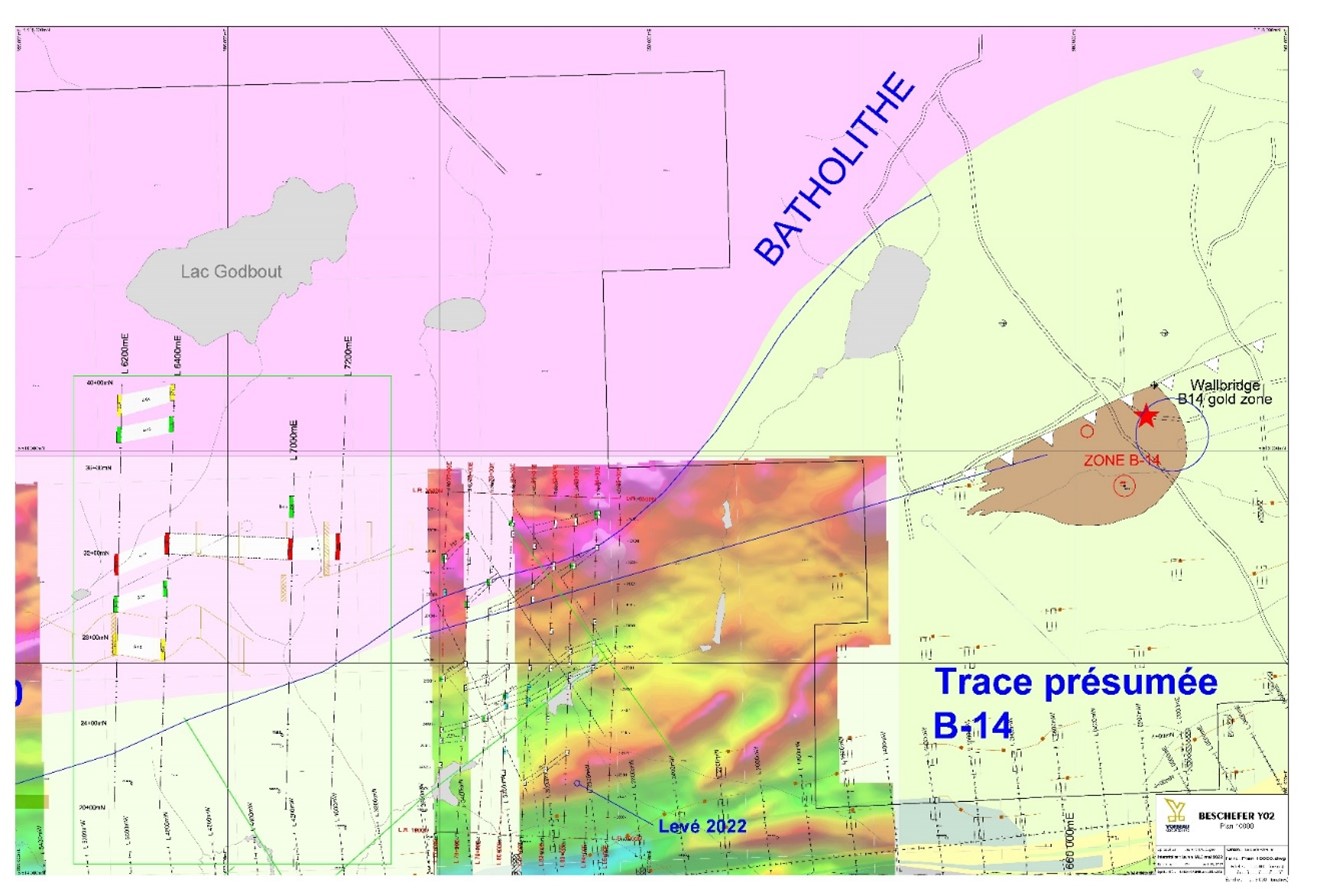

A second phase of work will be dedicated to sector B-14 in the northwest of the property. In this area, geophysical work in 2020 and 2021 revealed several geophysical anomalies along strike from the B-14 Zone. It is anticipated that these targets will be drilled in late 2025 or early 2026. Approximately 5,600 metres of drilling are planned for this phase.

The Beschefer property program consists of:

- Exploring immediately east of the Abitibi Metals boundary for the continuity of the copper-zinc-gold and silver mineralization of the B-26 Zone.

- Verifying on section 5750 E a strong alteration zone (West Zone 2 Rivindex) located more than 2 km from Zone B-26.

- For each hole drilled, execute a downhole EM survey and also survey some previous drilled holes.

- Testing several induced polarisation anomalies in the northern sector of the property, possibly representing the extension of the B-14 gold zone.

In parallel with these two phases, the compilation of work on the Selbaie-Ouest property is underway and the Company's geologists expect to propose an exploration program soon.

The Selbaie-Ouest property is located less than 3 km west of the recent Soquem discoveries (3.49% Zn, 7.9 g/t Ag, 0.33 Pb over 40.15 m) on the Selbaie horizon. This horizon continues within the Yorbeau property for more than 9 km. In 2008, Yorbeau drilled a series of holes at the eastern border of Yorbeau-Soquem and identified the Selbaie horizon with values of 1.7% Zn. Other results were obtained in the southwest, possibly within the B-26 horizon (0.5% Zn, 173 g/t Ag over 5.4 m). In 2012, hole SW-12A intersected a copper-nickel-cobalt zone in a gabbro. This zone of more than 20 metres of disseminated mineralization contained values up to 0.6% Cu, 0.24% nickel over 1.5 metres.

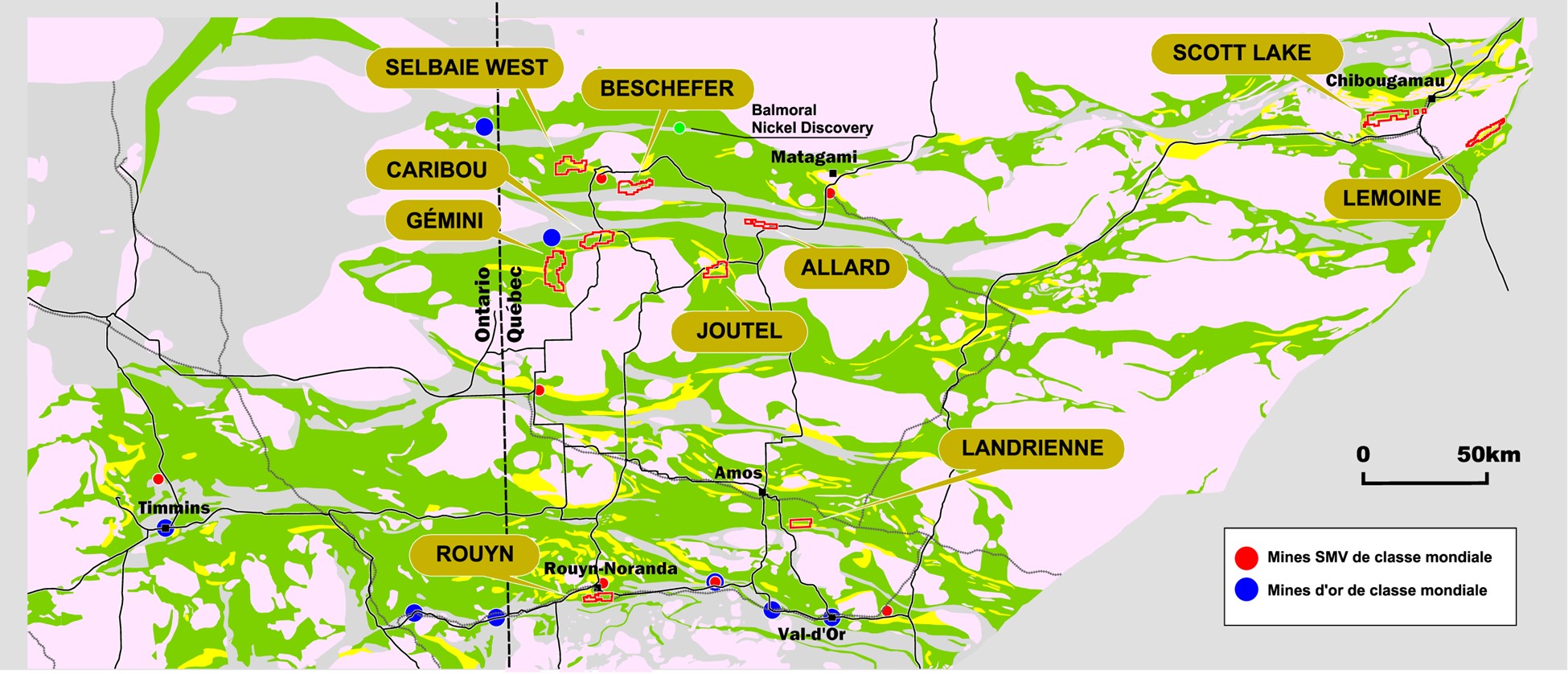

Over the past 12 months, the area of the former producer Mine Selbaie north of La Sarre has undergone major developments with the development of the B-26 Zone and the discovery of significant copper-zinc mineralization northwest of the Selbaie mine by Société Soquem (Yorbeau's Selbaie-Ouest property). In these areas, major work is underway including more than 56,000 metres of drilling. Yorbeau is in a strategic position with respect to these two projects. According to the knowledge acquired by Yorbeau, the host rocks of these deposits could logically continue for several kilometres within the boundaries of the Beschefer and Selbaie-Ouest properties (Figure 1). The Company therefore plans to carry out work for a total amount of approximately $2.0 million over the next 18 months on these two properties.

Yorbeau recently announced the completion of the sale of its Rouyn gold property to Lac Gold Rouyn Inc., for a total consideration of $25 million (press release dated December 16, 2024). Yorbeau intends to use the proceeds from the sale of the Rouyn property to fund exploration programs and pre-development activities on its other properties, including its 2025-2026 exploration work.

The scientific and technical content of this press release has been reviewed, prepared, and approved by Mr. Laurent Hallé, Senior Mineral Exploration Consultant with Yorbeau, who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Yorbeau Resources Inc.

Yorbeau Resources is a Canadian public company (TSX: YRB) involved in gold and base metal exploration in Quebec, Canada. The Company’s focus is on seeking a partner to further explore and develop its Scott Lake zinc copper deposit near Chibougamau Quebec (refer to Yorbeau’s National Instrument 43-101 compliant technical report dated December 6, 2017, titled “Technical Report on the Preliminary Economic Assessment for the Scott Lake Project, Northwestern Québec, Canada,” available on the Company’s SEDAR+ profile at www.sedarplus.ca). Yorbeau also intends to focus on continuing exploration on its well-located properties in the Detour, Joutel and Selbaie region of north western Quebec. These properties include the Beschefer property which is adjacent to the B-26 base metal deposit now being explored by Abitibi Metals Corp. and the Selbaie West property adjacent to Soquem (Wagosic property) where they are presently intersecting base metal values along the Selbaie mine horizon.

Additional information about the Company is available on its website in https://www.yorbeauresources.com.

For more information, visit the website: https://www.yorbeauresources.com or contact

G. Bodnar Jr.

President and CFO

Ressources Yorbeau Inc.

Tel: 514-384-2202

gbodnar@yorbeauresources.com

Laurent Hallé P. Geo

Senior Consultant

Ressources Yorbeau Inc.

Tel: 819-629-9758

lhalle@yorbeauresources.com

Toll-free in North America: 1 (855) 384-2202

Forward-Looking Statements: Except where statements are made with respect to historical facts, all statements contained in this news release, including those relating to the drilling program, any future exploration plans of the Company, the intended use of proceeds from the sale of the Rouyn property, as well as any statements relating to future plans and objectives, are forward-looking statements that involve significant risks and uncertainties. There can be no assurance that these statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in these statements. Yorbeau disclaims any obligation to update these statements unless required by applicable securities laws.