Yorbeau closes third and final tranche of non-brokered private placement

![]() Download PDF version | View all documents on Sedar

Download PDF version | View all documents on Sedar

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

Montreal, August 7, 2023 – Yorbeau Resources Inc. (TSX: YRB) (the “Company” or “Yorbeau“) is pleased to announce that it has completed the third and final tranche of a $1,200,000 private placement (the “Private Placement“) by issuing on August 4 2023 8,898,333 Class A common shares comprised of 3,668,333 “flow-through“ Class A common shares at a price of $0.07 per share and 5,230,000 non-flow-through Class A common shares at a price of $0.035 per share for an aggregate gross proceeds of $439,833. The first and second tranches of the Private Placement generated an aggregate of $760,167 in gross proceeds for the Company, as previously announced by the Company on June 30, 2023.

The Company will use the proceeds raised from the issue of the flow-through Class A common shares to incur Canadian exploration expenses on its properties and the proceeds raised from the issue of the non-flow-through Class A common shares for general corporate purposes.

Four directors of the Company, namely Messrs. Terry Kocisko, Georges Bodnar Jr., Henri Gélinas, and Dany Laflamme, subscribed for 3,096,429, 485,714, 861,457 and 1,703,333 Class A common shares, respectively, and a total of 6,146,933 Class A common shares in the aggregate having an aggregate subscription price of $336,534.31. As insiders of the Company participated in the Private Placement, it is deemed to be a “related party transaction” as defined under Multilateral Instrument 61-101—Protection of Minority Security Holders in Special Transactions (“MI 61101“). The Private Placement was reviewed and approved by the board of directors of the Company, with interested directors abstaining from voting on such approval following a disclosure of their interest in the Private Placement as required under the Business Corporations Act (Québec). The Private Placement is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 (pursuant to subsections 5.5(a) and 5.7(a)) as neither the fair market value of the Class A common shares distributed to, nor the consideration received from, interested parties exceeded 25% of the Company’s market capitalization. The Company did not file a material change report at least 21 days prior to the closing of the first and second tranches of the Private Placement as participation of the insiders had not been confirmed at that time.

The Company paid finder fees in the aggregate amount of $3,572 with respect to a portion of the third tranche of the Private Placement.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act“), or any state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of U.S. persons (as defined in Regulation S under the 1933 Act) absent such registration or an applicable exemption from such registration requirements.

About Yorbeau Resources Inc.

Yorbeau Resources Inc. is a Canadian public company (TSX: YRB) involved in gold and base metal exploration in Quebec, Canada. Its properties are in northwestern area of the province containing many significant deposits on the famed Abitibi Greenstone Belt, including major gold mines along the Larder Lake- Cadillac Break and several volcanic centers hosting major copper-zinc-gold deposits.

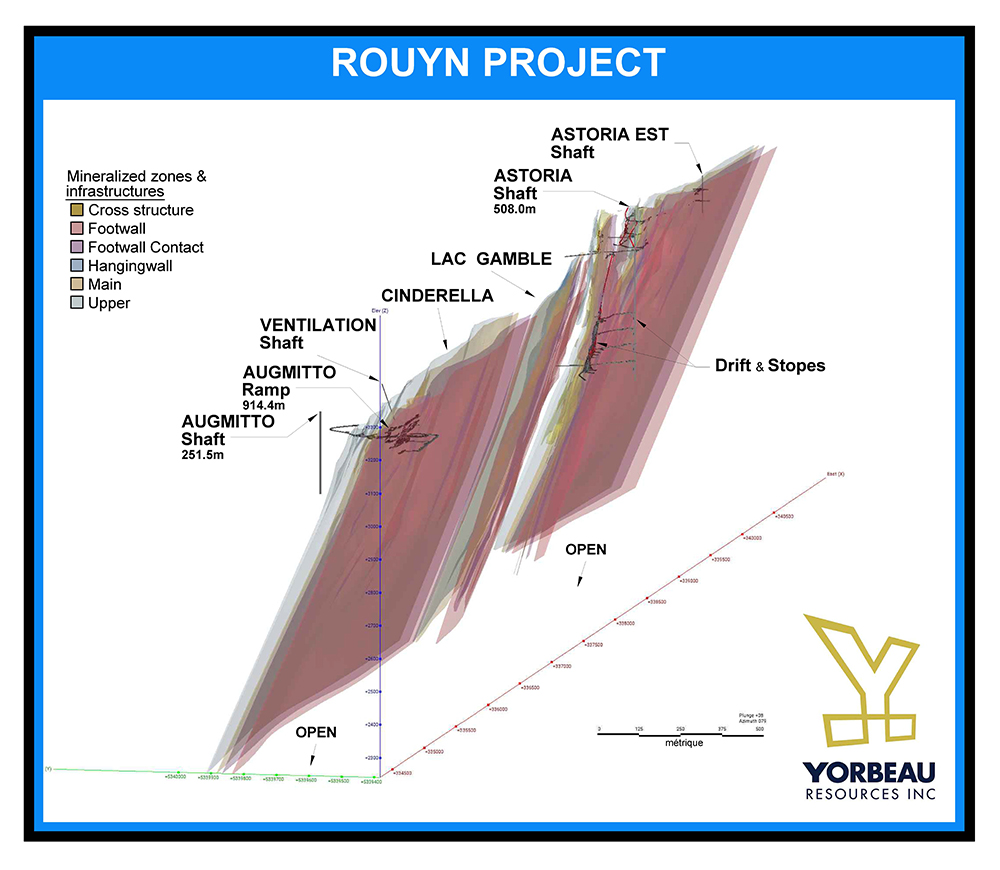

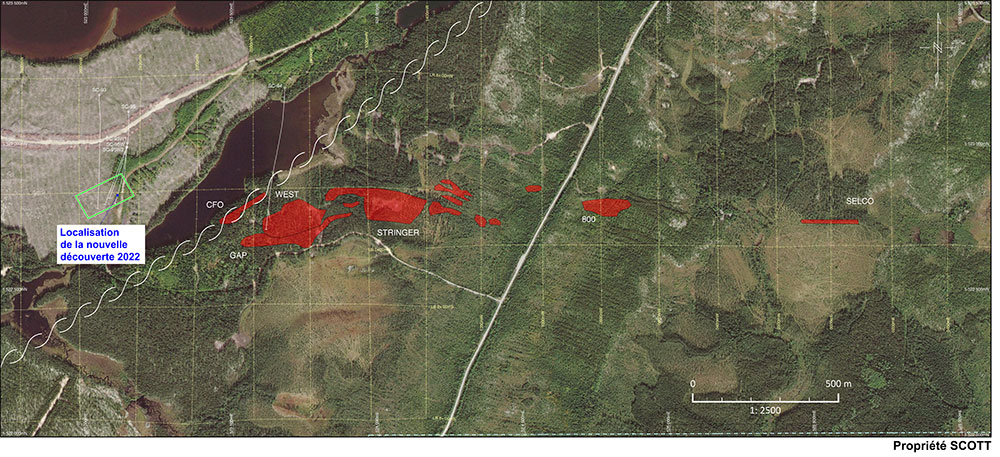

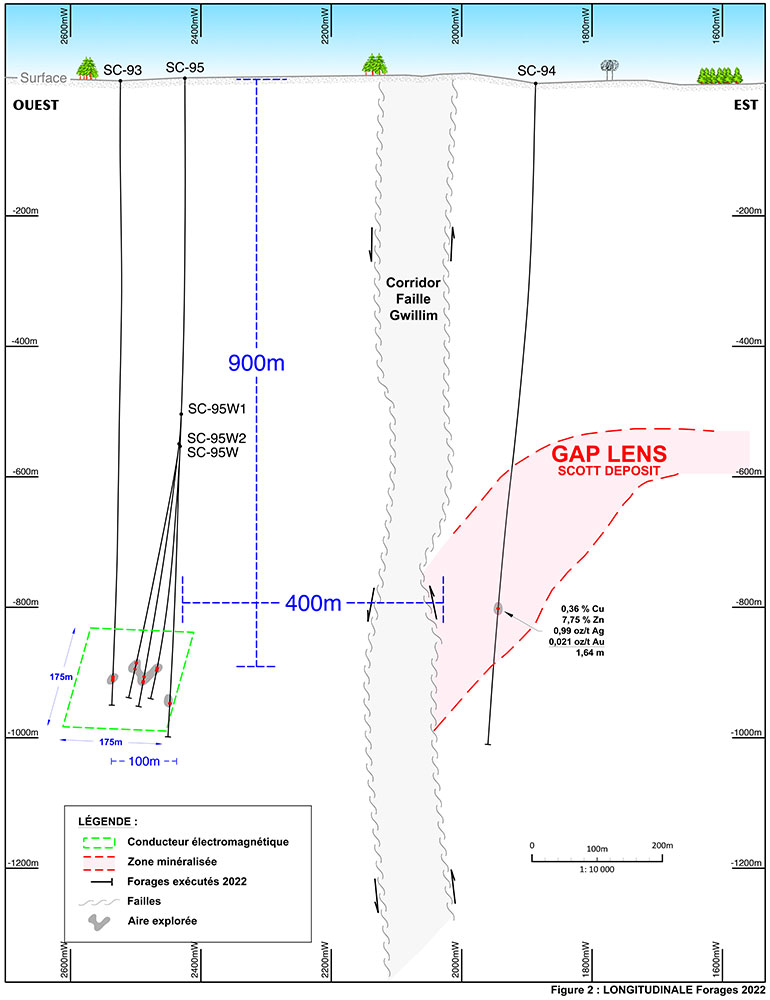

Yorbeau is focusing on its Rouyn Gold and Scott Lake Zinc-Copper projects which have demonstrated the most immediate and substantial prospects for discovery and eventual mine development. While Scott is very favorably located in the Chibougamau mining camp, Rouyn represents a consolidation of several contiguous properties strategically located on the famously productive Cadillac Break in the Rouyn-Noranda Mining Camp. Other holdings of the Company include its interest in the past producing Joutel Gold Mining Camp and the Beschefer Property adjacent to SOQUEM’s B-26 deposit in the Selbaie Mine area.

For more information, please visit our website at https://www.yorbeauresources.com.

For further information, please contact:

G. Bodnar Jr.

President, Chief Financial Officer

Yorbeau Resources Inc.

gbodnar@yorbeauresources.com

Tel: 514-384-2202

Toll free in North America: 1-855-384-2202

Forward-looking statements: Except for statement of historical fact, all statements in this news release, including, without limitation, statements regarding the use of proceeds of the Private Placement are forward-looking statements which involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from those anticipated in such statements. Yorbeau disclaims any obligation to update such forward-looking statements, other than as required by applicable securities laws.