IAMGOLD continues to deliver strong results from Lac Gamble zone at the Yorbeau Rouyn project, including 6.1 g/t Au over 23.4 metres

Home » news-releases » Page 6

![]() Download PDF version | View all documents on Sedar

Download PDF version | View all documents on Sedar

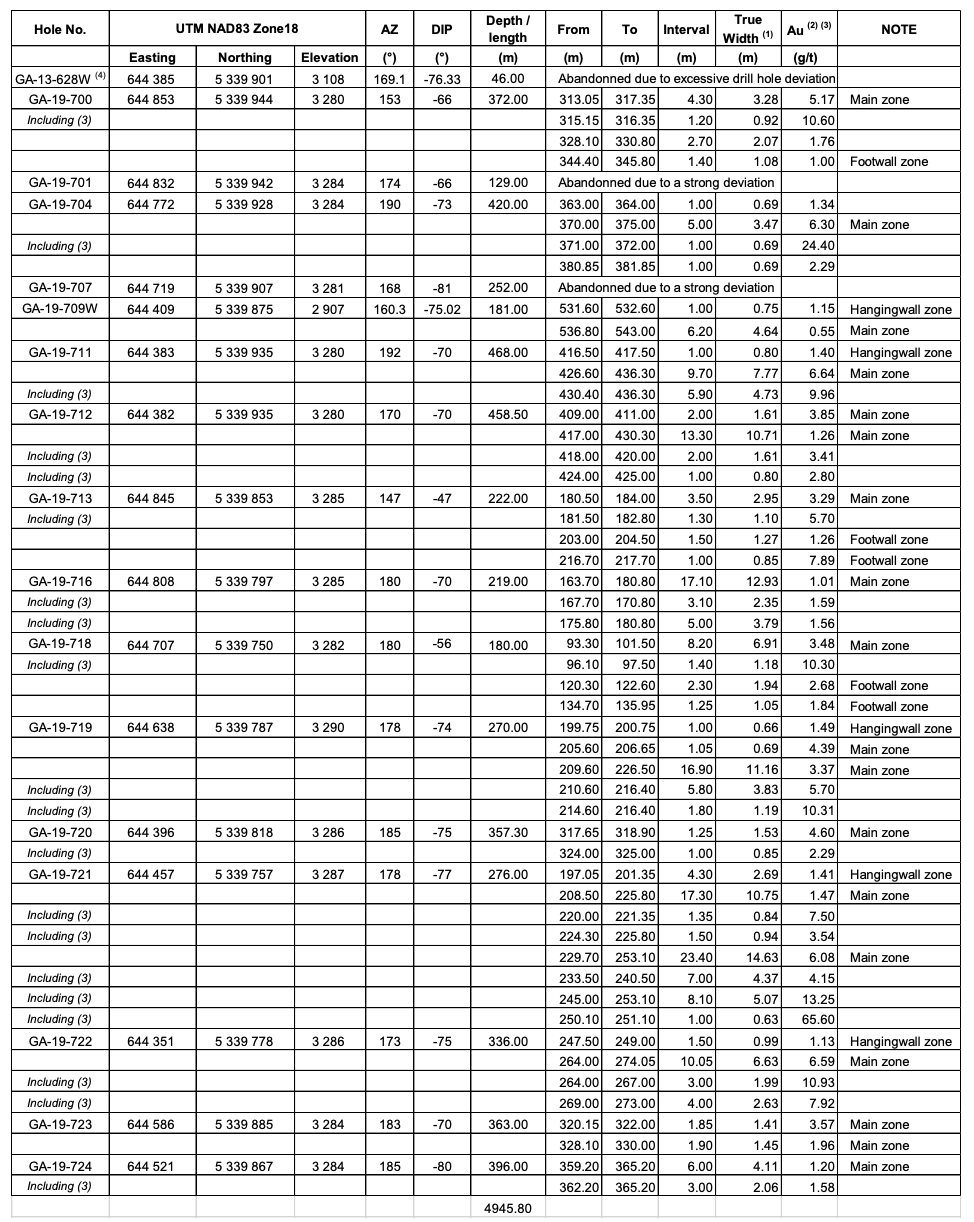

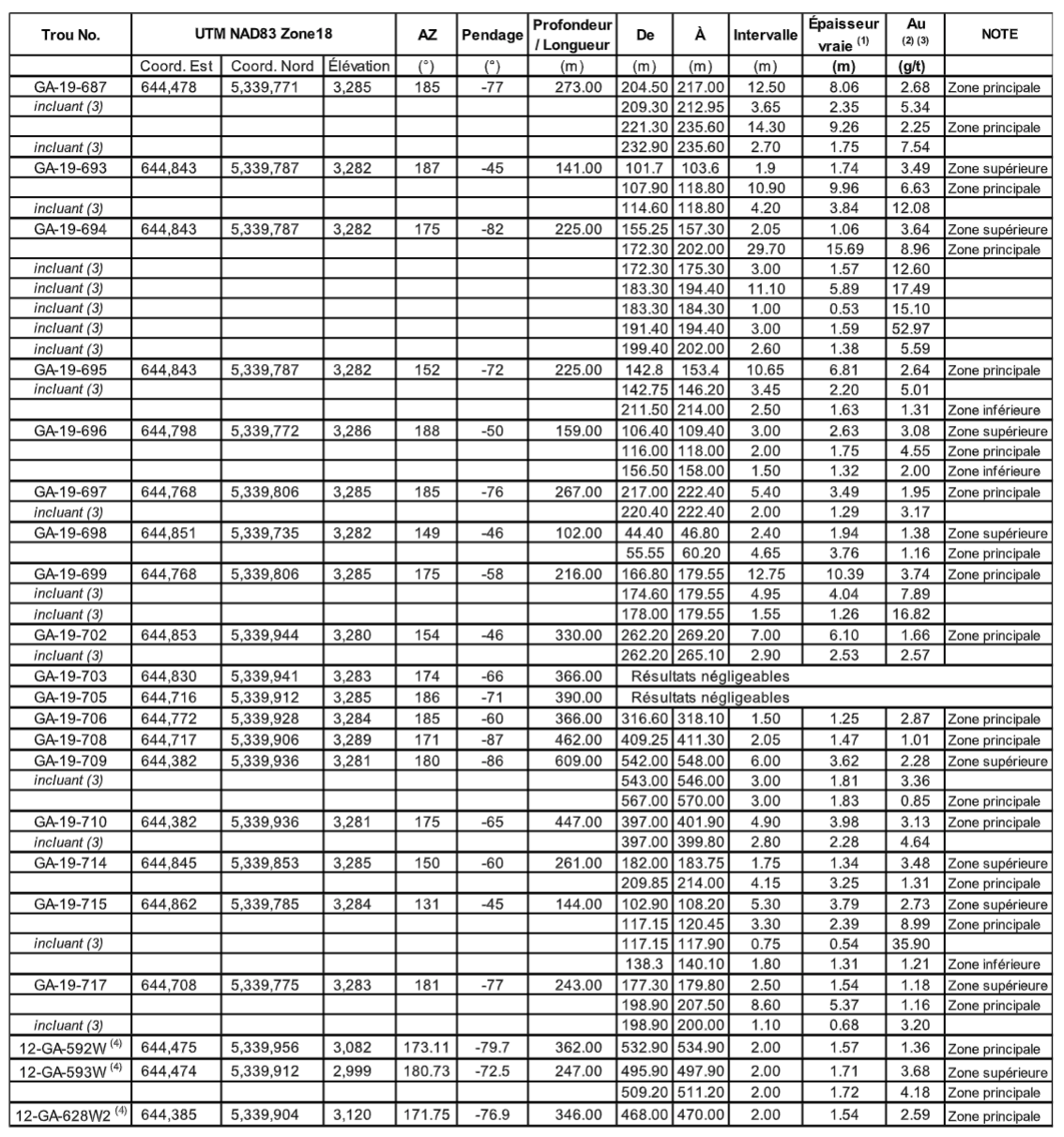

MONTREAL, July 31, 2019 - Yorbeau Resources Inc. (TSX: YRB) (the "Company" or "Yorbeau") is pleased to report that its partner IAMGOLD Corporation ("IAMGOLD") released today the remaining results from its 2019 winter diamond drilling program completed at the Company's Rouyn project, located 4 km south of Rouyn-Noranda, Quebec. IAMGOLD reported assay results from an additional 17 diamond drill holes, totaling 4,946 metres. Three (3) drill holes were abandoned due to excessive deviation and re-collared. Results for 31 diamond drill holes totaling 8,438 metres were previously reported (see news releases dated May 23 and June 12, 2019).

Notes:

- True widths of intersections are estimated at 62-85% of the core interval approximately.

- Drill hole intercepts are calculated with a lower cut of 1.00 g/t Au and may contain lower grade interval of up to 3 metres in length.

- Assays are reported uncut but high grade sub-intervals are highlighted.

- Drill holes with the suffix W are wedge cuts from previously drilled master holes.

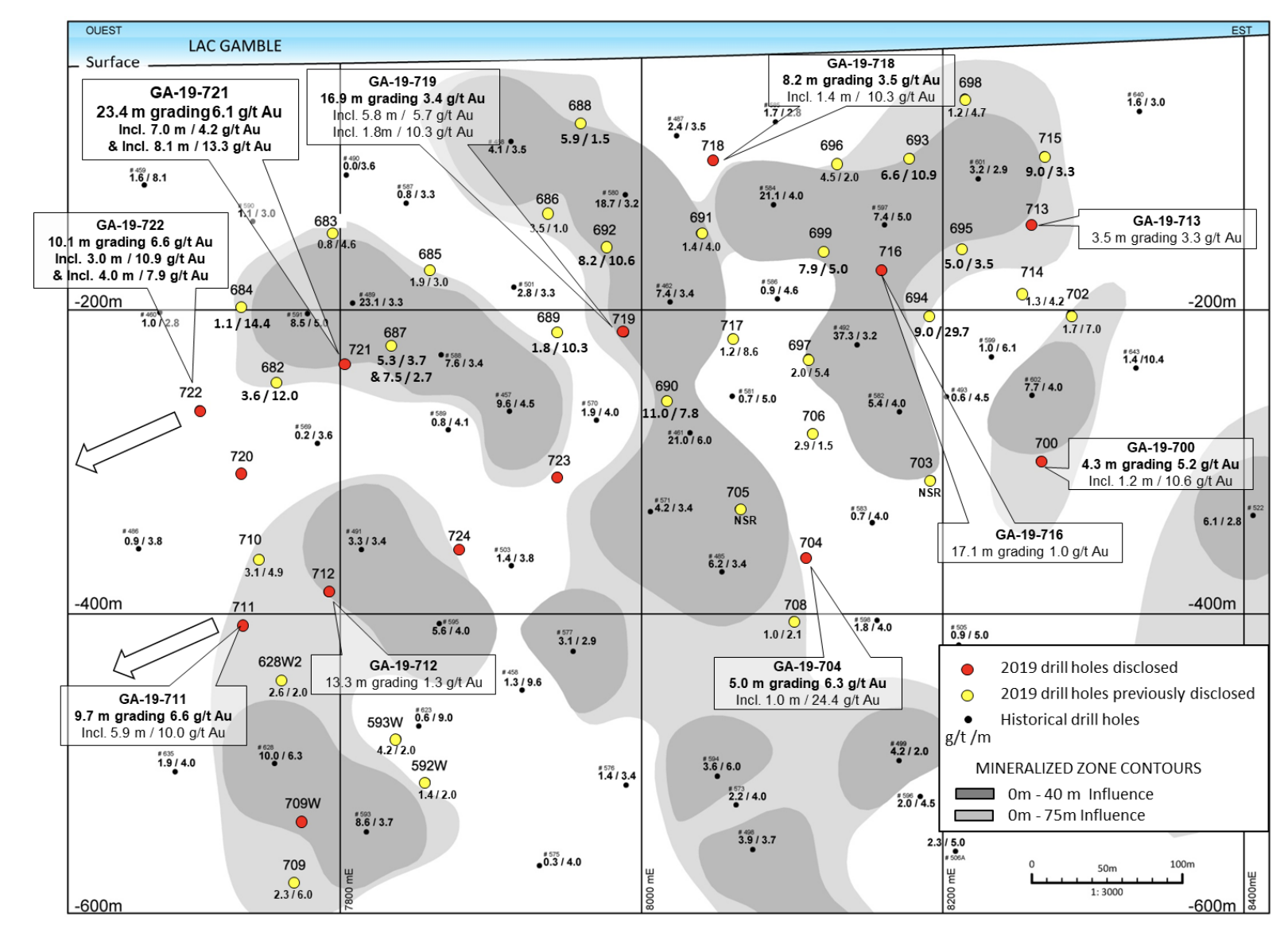

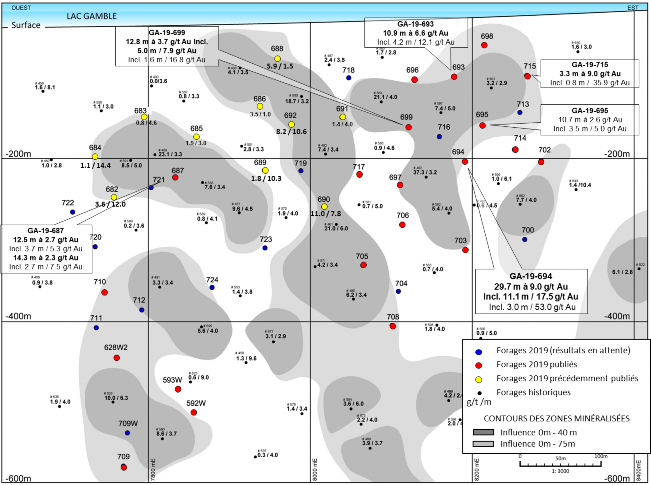

The assay results reported herein are provided in Table 1 below and include the following highlights (a longitudinal section illustrating the drilling program on the Lac Gamble zone is attached to this news release):

Main Zone:

- Drill hole GA-19-711: 9.7 metres grading 6.6 g/t Au

includes: 5.9 metres grading 10.0 g/t Au - Drill hole GA-19-719: 16.9 metres grading 3.4 g/t Au

includes: 5.8 metres grading 5.7 g/t Au

includes: 1.8 metres grading 10.3 g/t Au - Drill hole GA-19-721: 23.4 metres grading 6.1 g/t Au

includes: 8.1 metres grading 13.3 g/t Au

includes: 1.0 metres grading 65.5 g/t Au - Drill hole GA-19-722: 10.1 metres grading 6.6 g/t Au

includes: 3.0 metres grading 10.9 g/t Au

and includes: 4.0 metres grading 7.9 g/t Au

The objective of the 2019 winter diamond drilling program was to infill a portion of the Lac Gamble zone previously drilled by Yorbeau and various joint venture partners. The program was designed to achieve an approximate 50 x 50 metres drill hole spacing pattern to ultimately support the completion of a mineral resource estimate. The completed drill holes successfully intersected the targeted sheared Cadillac-Piché corridor which hosts the mineralized zone. The zone is characterized by alteration observed to vary from several metres to greater than ten metres in width, exhibiting variable carbonatization, fuchsite, silicification, crosscut by a network of white quartz and brown tourmaline stockwork veins and breccias. Gold mineralization occurs as small specks of visible free gold associated with minor sulphides in quartz-tourmaline veinlets.

Gérald Riverin, Company president commented: "This latest series of assays released by our partner IAMGOLD are most encouraging. Broadly speaking, the delineation drilling program completed recently has confirmed our interpretations of the Lac Gamble zone and met with our expectations. In particular, the core lengths and grades of some of the intersections, combined with the apparent opening of the mineralization to the west, augur well for the future. We are looking forward to future work at Lac Gamble and on the rest of the Rouyn property."

In a separate press release on the current results, Craig MacDougall, Senior Vice President, Exploration for IAMGOLD, stated: "We are very pleased with the positive results obtained from our first delineation drilling program completed earlier this year at Lac Gamble. The program successfully targeted mineralization in the upper part of the zone with a number of drill holes intersecting good grades over wide intervals. The zone also appears to remain open along strike to the west and at depth and therefore has potential for further expansion with additional drilling. We look forward to incorporating the results from this drilling program to develop a robust deposit model to allow for the completion of a future resource estimate. I would like to acknowledge that the success of this initial program benefited significantly from the close collaboration between the IAMGOLD and Yorbeau exploration teams."

Next Steps

The results of this initial diamond drilling program will be compiled and integrated with the existing geological, geochemical and structural information to support the development and refinement of a preliminary deposit model. This work will be used to support the completion of a mineral resource estimation of the Lac Gamble zone currently in planning.

Drilling has also resumed to test selected exploration targets in the area of the historic Astoria deposit, located several kilometres to the east of Lac Gamble. The program will involve the completion of approximately 5,000 metres of diamond drilling and assay results will be reported once they are received, validated and compiled.

About the Rouyn Gold Project

The Rouyn Gold Property is located about 4 km south of Rouyn-Noranda, Quebec. With a long history of mining, the city of Rouyn-Noranda offers many advantages for mining and exploration, including political and social stability, good access and infrastructure, skilled mining personnel, and one of the most mining-friendly jurisdictions in the world.

The property covers a 12-kilometre stretch of the Cadillac-Larder Lake Break and contains four known gold deposits along the 6-km Augmitto-Astoria corridor situated on the western portion of the property. Two of the four deposits, Astoria and Augmitto, benefit from established underground infrastructure and have been the subject of technical reports that include resource estimates that were previously filed in accordance with Regulation NI 43-101.

The Lac Gamble zone is located between the Augmito and the Astoria deposits. The exploration target potential at Lac Gamble is interpreted to be between 400,000 and 600,000 ounces of gold at a grade between 7.0 and 8.5 g/t Au. The potential quantity and grade of the exploration targets referred to are conceptual in nature and insufficient exploration work has been completed to define a mineral resource. The property may require significant future exploration to advance to a resource stage and there can be no certainty that the exploration target will result in a mineral resource being delineated. The exploration targets are consistent with similar deposits in the area, deposit models or derived from initial drilling results.

IAMGOLD signed a definitive option agreement in December 2018, whereby IAMGOLD has the option to acquire a 100% interest in the Project by making scheduled cash payments totaling C$4 million and completing exploration expenditures totaling C$9 million over a four year period. Exploration programs must include the completion of a minimum of 20,000 metres of diamond drilling within the first two-years of the option. By the end of the expenditure period, the Company must complete a NI 43-101 compliant resource estimate, after which the Company, at its election, can purchase a 100% interest in the Project, subject to a 2% net smelter return production royalty, by paying Yorbeau the lesser of C$15 per resource ounce or C$30 million.

Technical Information and Quality Control Notes

The drilling results contained in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Work at Yorbeau is carried out under the supervision of Gérald Riverin, PhD, P. Geo. He is a qualified person (as defined by NI 43-101) and has reviewed and approved the content of this release.

The design of the drilling program and interpretation of results is under the control of IAMGOLD's and Yorbeau's geological staff, including qualified persons employing strict protocols consistent with NI 43‑101 and industry best practices. The sampling of, and assay data from, the drill core is monitored through the implementation of a quality assurance - quality control (QA-QC) program. Drill core (NQ size) is logged and samples are selected by geologists and then sawn in half with a diamond saw at the project site. Half of the core is retained at the site for reference purposes. Sample intervals may vary from half a metre to one and a half metres in length depending on the geological observations.

Half-core samples are packaged and transported in sealed bags to AGAT laboratories in Val d'Or, Quebec, and Mississauga, Ontario. Samples are coarse crushed to a -10 mesh and then a 1,000 gram split is pulverized to 95% passing -150 mesh. AGAT prepare analytical pulps at their facilities located in Val-d'Or and processed the pulps at their Mississaugalaboratory which is ISO / IEC 17025:2005 certified by the Standards Council of Canada. Samples are analyzed using a standard fire assay with a 50 gram charge with an Atomic Absorption (AA) finish. For samples that return assay values over 3.0 grams per tonne, another pulp is taken and fire assayed with a gravimetric finish. Core samples showing visible gold or samples which have returned values greater than 10.0 grams per tonne are processed with a protocol involving fine grinding of the entire sample, followed by metallic screen analysis of the entire pulverized material. Insertion of duplicate, blanks and certified reference standards in the sample sequence is done in all drill holes for quality control.

About Yorbeau Resources Inc.

The Rouyn Property, wholly-owned by the Company, contains four known gold deposits in the 6‑km‑long Augmitto-Astoria corridor situated on the western portion of the property. The Company signed a definitive agreement in December 2018, whereby IAMGOLD has the option to acquire a 100% interest in the Rouyn property, and a major drilling program is underway. Two of the four deposits, Astoria and Augmitto, benefit from substantial underground infrastructure and have been the subject of technical reports that include resource estimates and that were filed in accordance with Regulation 43-101. In 2015, the Company expanded its exploration property portfolio by acquiring strategic base metal properties in prospective areas of the Abitibi Belt of Quebec and Ontario that feature an infrastructure favourable for mining development. The newly acquired base metal properties include the Scott Project, which bears important mineral resources (see the press release dated March 30, 2017) and on which a positive Preliminary Economic Assessment was recently completed.

For additional information on the Company, consult its website at www.yorbeauresources.com.

For further information, please contact:

Gérald Riverin, PhD, P. Geo

President, Yorbeau Resources Inc.

Yorbeau Resources Inc.

griverin@yorbeauresources.com

Tel: 819-279-1336

G. Bodnar Jr.

Vice-President, Chief Financial Officer

Yorbeau Resources Inc.

gbodnar@yorbeauresources.com

Tel: 514-384-2202

Toll free in North America: 1-855-384-2202

Forward-looking statements: Except for statement of historical fact, all statements in this news release, including without limitation, regarding the prospects of the Rouyn project, drilling results, future plans and objectives are forward‑looking statements which involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from those anticipated in such statements. Yorbeau disclaims any obligation to update such forward-looking statements, other than as required by applicable securities laws.