Download PDF version | Views all documents on Sedar

Download PDF version | Views all documents on Sedar

Montréal, August 29, 2017- Yorbeau Resources Inc. (TSX: YRB) (the “Company” or “Yorbeau”) is pleased to report results from metallurgical tests at its Scott project in Quebec.

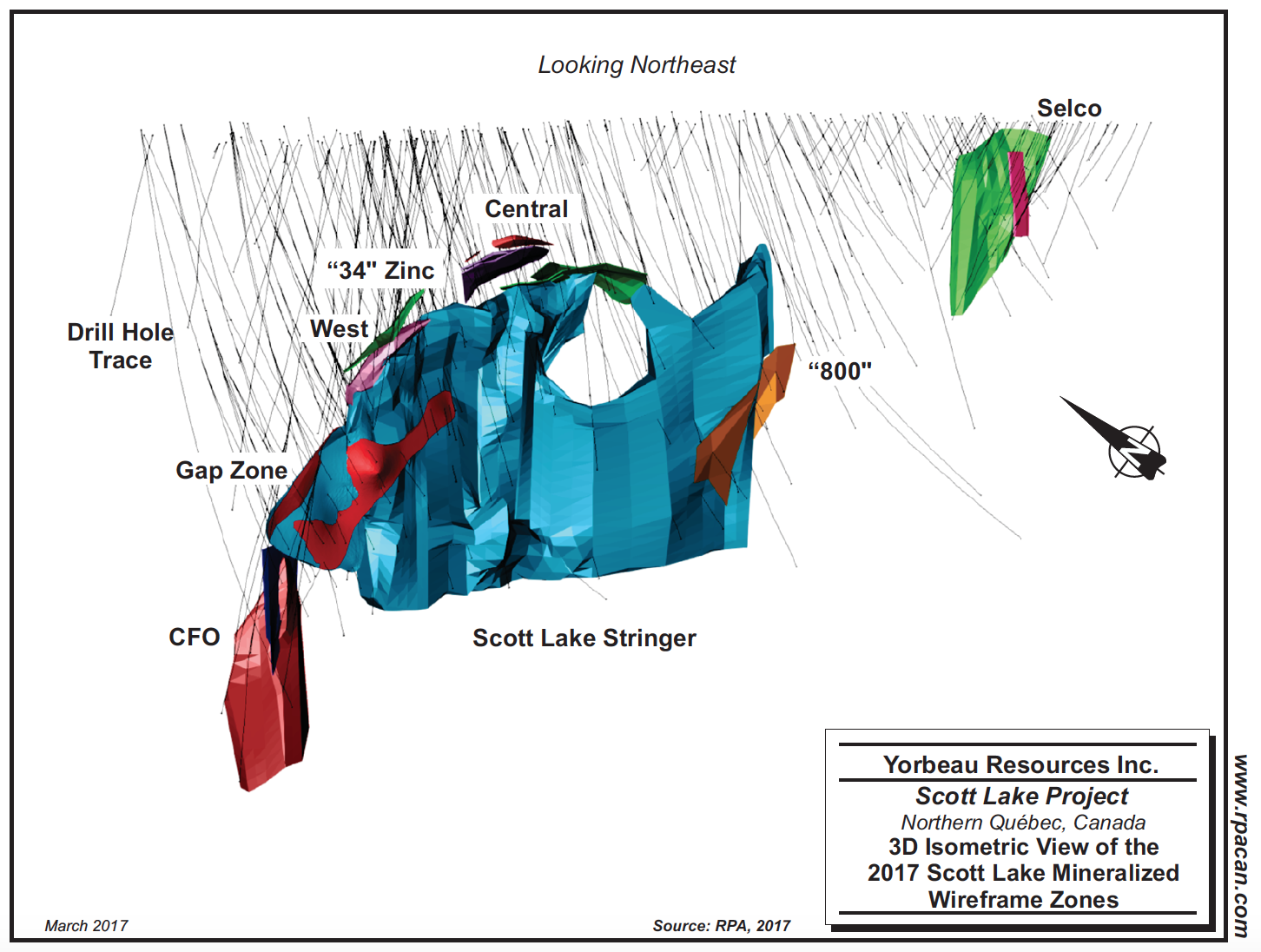

A composite sample weighing 55 kilograms was prepared from drill core selected from several representative drill holes from all mineralized zones forming the Mineral Resources except the Selco lens. The composite sample is considered to be representative of the Mineral Resources and contained approximately the same ratio of massive sulphides and stringer sulphides as shown in the Mineral Resources (re: press release of March 30, 2017).

A series of metallurgical tests were completed by Chibougamau-based Services Métallurgiques Metchib, in cooperation with SGS Canada Inc. in Québec city. The work done includes a mineralogical characterization (QEMSCAN), a Davis Tube magnetic test, an oxidation and activation test, 11 batch flotation tests, and a “locked cycle” flotation test. The batch flotation tests were done to determine the response of the mineralization to various grinds and flotation parameters, and to determine the process and flowsheet to be used for the locked cycle test. The locked cycle test was designed to replicate at bench scale, as much as possible, the physical and chemical conditions that would ultimately be used at industrial scale in a concentrator.

Based on the QEMSCAN analysis and the preliminary tests, a primary grind of 55 microns was selected for the tests. A total of six cycles were completed in the locked cycle test. The concentrates obtained in cycles B and C are considered representative of the final copper concentrate, while the concentrate obtained in cycle F is considered the closest representative of the final zinc concentrate (see details below). The highlights of the tests are presented below.

Copper concentrate

- In the chalcopyrite batch flotation tests various copper concentrate grades were obtained, ranging from 19% Cu to 33% Cu, and a good copper concentration potential with low zinc content was shown.

- During the locked cycle test, the highest copper grade achieved in a given cycle was 27.2% Cu.

- The locked cycle test (cycles B-C) showed an overall 82% copper recovery in a 23.3% Cu concentrate.

- Copper concentrate grade for cycle B:

| % Cu |

% Zn |

g/t Au |

g/t Ag |

Fe% |

| 25.4 |

6.5 |

8.5 |

612 |

27.5 |

- Although the full mass balance and recovery estimate still remain to be done for gold, the high gold and silver grades in the copper concentrate are very encouraging. These results reflect the strong affinity between precious metals and the copper concentrate, which is critical for recovery of payable precious metals.

- According to the report submitted by Metchib’s metallurgists, it appears in light of all the metallurgical test work done for the Scott deposit, that once the optimization of the process is done, it will be possible to achieve an 84% copper recovery at 25% Cu in the copper concentrate.

- Trace element content – copper concentrate cycle B:

| arsenic |

<30 |

berylium |

<0.07 |

bismuth |

<200 |

| cadmium |

137 |

cobalt |

<30 |

mercury |

1.4 |

| lead |

7500 |

antimony |

<20 |

selenium |

<50 |

All analyses in ppm (parts per million)

Zinc concentrate

- In the sphalerite batch flotation tests, a recovery of over 80% was achieved at a concentrate grade of 48% Zn, this before any cleaner stage. A higher recovery was expected during the locked cycle test, since the Cu cleaner tails stream is to be sent into the zinc circuit.

- The locked cycle test showed an overall 83% zinc recovery in a 51.1% Zn concentrate.

- Zinc concentrate grade for the last cycle F:

| % Cu |

% Zn |

g/t Au |

g/t Ag |

Fe% |

| 0.6 |

53.3 |

0.27 |

63.6 |

11.9 |

- According to the report submitted by Metchib’s metallurgists, it appears in light of all the metallurgical test work done for the Scott deposit, that once the optimization of the process is done, it will be possible to achieve an 87% zinc recovery at 55% Zn in the zinc concentrate.

- Trace element content – zinc concentrate cycle F:

| arsenic |

<30 |

berylium |

<0.07 |

bismuth |

<200 |

| cadmium |

1110 |

cobalt |

<30 |

mercury |

3.0 |

| lead |

771 |

antimony |

<20 |

selenium |

<50 |

All analyses in ppm (parts per million)

The concentrates produced in the tests are clean of typical unwanted (so-called “nasty”) elements such as arsenic, antimony, cadmium and mercury. Other metals such as lead and zinc in the copper concentrate, or iron in the zinc concentrate, have good potential of being reduced while upgrading the concentrates during process optimization. Therefore, both the copper and the zinc concentrates appear to be of “commercial quality”, particularly in terms of copper and zinc grades, but also in terms of their very low contents of arsenic, mercury, and cadmium.

The above metallurgical results were obtained from “standard” flotation process with “off the shelf” standard reagents. They represent a very important milestone for the Scott project and will serve as additional strong technical support for the on-going Preliminary Economic Assessment by Roscoe Postle Associates.

Gérald Riverin, Company president commented: “We are very pleased with the results obtained in the metallurgical test. Indeed, while a critical milestone for the Scott project was reached by outlining very important mineral resources, the metallurgical test is yet another important milestone. Indeed, the results of the test clearly indicate that zinc and copper recoveries are very good and, most importantly, that excellent metal concentrates comparable to typical commercial grade concentrates can be obtained from the resources. The next step will be the completion of the on-going Preliminary Economic Assessment.”

Metallurgical work was performed and supervised by Jonathan Lapointe, P.Eng., of Services Métallurgiques Metchib, and Dominique Lascelle, M.Eng., of SGS. Chemical analyses were done by SGS. The work was commissioned for Yorbeau by Gérald Riverin, PhD, P. Geo. He is a qualified person (as defined by NI 43-101) and has reviewed and approved the content of this release.

About Yorbeau Resources Inc.

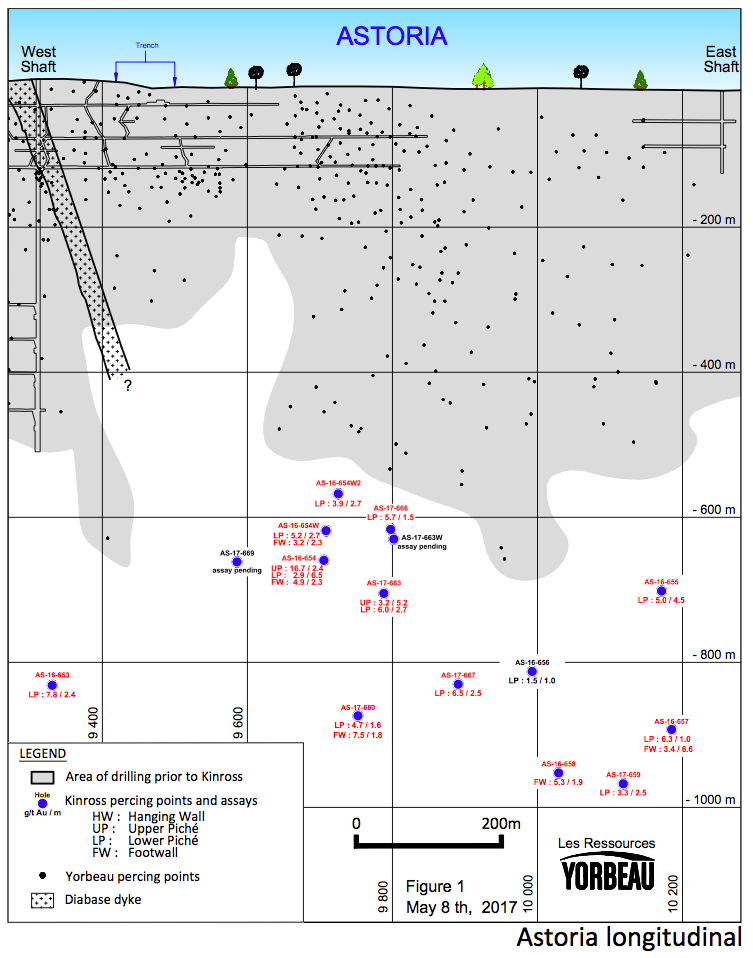

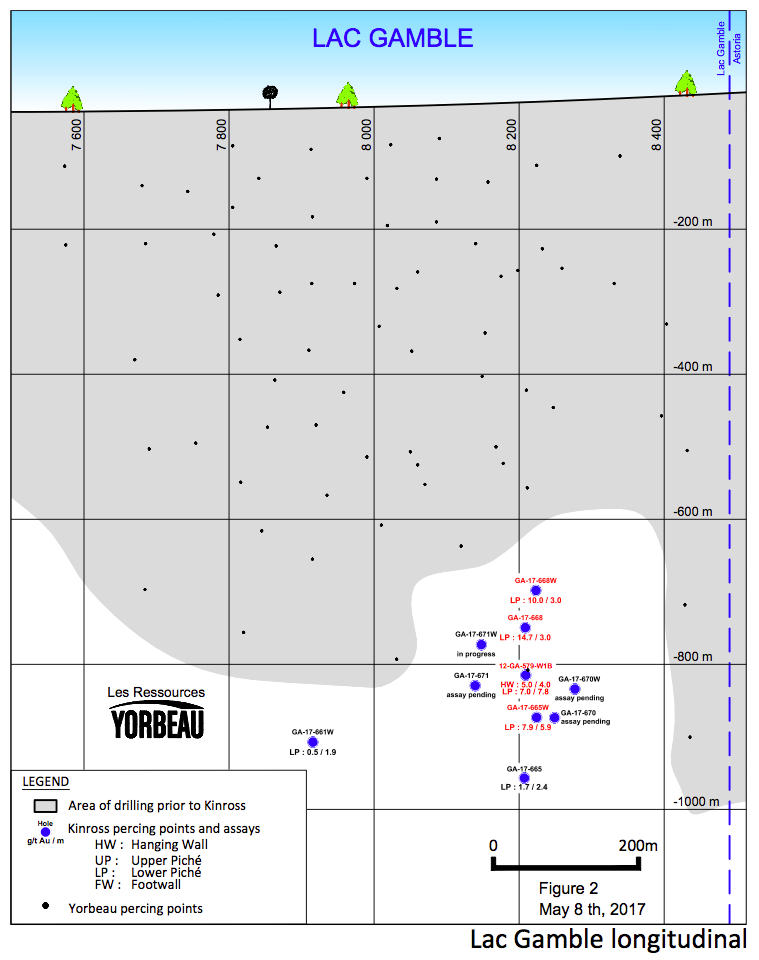

The Company's 100% controlled Rouyn Property contains four known gold deposits in the 6-km-long Augmitto-Astoria corridor situated on the western half of the property. Two of the four deposits, Astoria and Augmitto, have substantial underground infrastructure and have been the subject of NI 43-101 technical reports that include resource estimates. The Company recently announced signing an Option Agreement with an affiliate of Kinross Gold Corporation to pursue exploration on the Rouyn Property (see press release dated October 25, 2016). In 2015, the Company expanded its exploration property portfolio by acquiring strategic base metal properties in prospective areas of the Abitibi Belt of Quebec and Ontario that also feature infrastructure favourable for mining development. The newly acquired base metal properties include Scott Lake which hosts important mineral resources (see press release dated March 30, 2017).

More information on the Company may be found on the Company's website at www.yorbeauresources.com.

For further information, please contact:

Gérald Riverin, Ph D., P. Geo

President

Yorbeau Resources Inc.

griverin@yorbeauresources.com

Tel : 819-279-1336

G. Bodnar Jr.

Vice President

Yorbeau Resources Inc.

gbodnar@yorbeauresources.com

Tel.: 514-384-2202

Toll free in North America: 1-855-384-2202

Forward-looking statements: Except for statement of historical fact, all statements in this news release, without limitation, regarding the aggregate size of the private placement and the use of proceeds of the private placement are forward-looking statements which involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from those anticipated in such statements.

![]() Download PDF version | Views all documents on Sedar

Download PDF version | Views all documents on Sedar