Scott

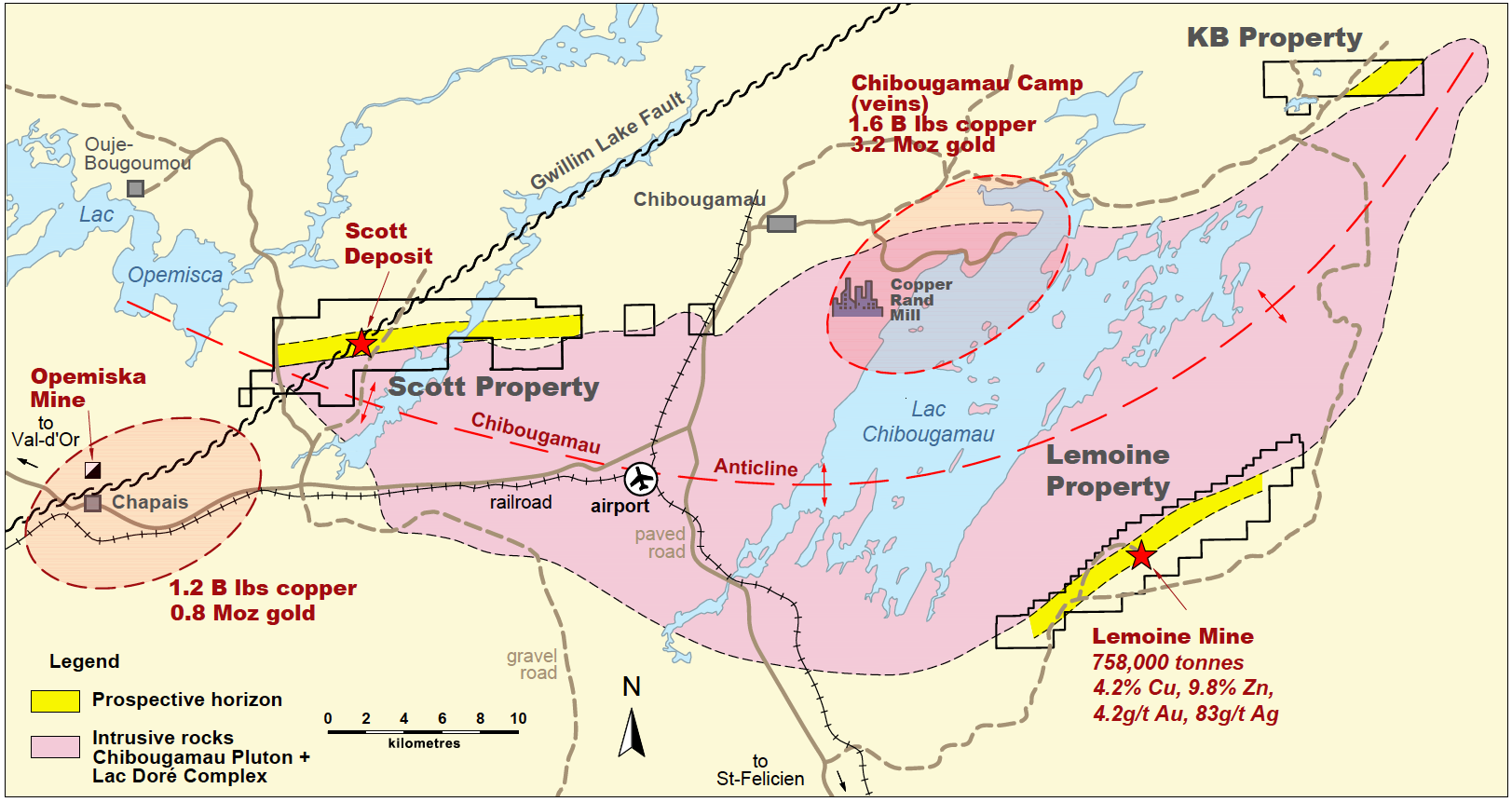

The Scott Lake project is located in the Chibougamau area approximately 20 km west of the town of Chibougamau. The property includes three (3) distinct blocks: the Ouje Claims, the Thundermin block and the Scott-Diagold block.

All of the blocks are 100% owned by Yorbeau but may be subject to underlying royalty agreements. The property is located on the north limb of the Chibougamau Anticline and covers 18 kilometres of strike length of felsic rocks of the Waconichi Formation.

On the south limb of the Anticline, the Waconichi hosts the past producing high grade Lemoine mine which is now part of the Company's Lemoine project.

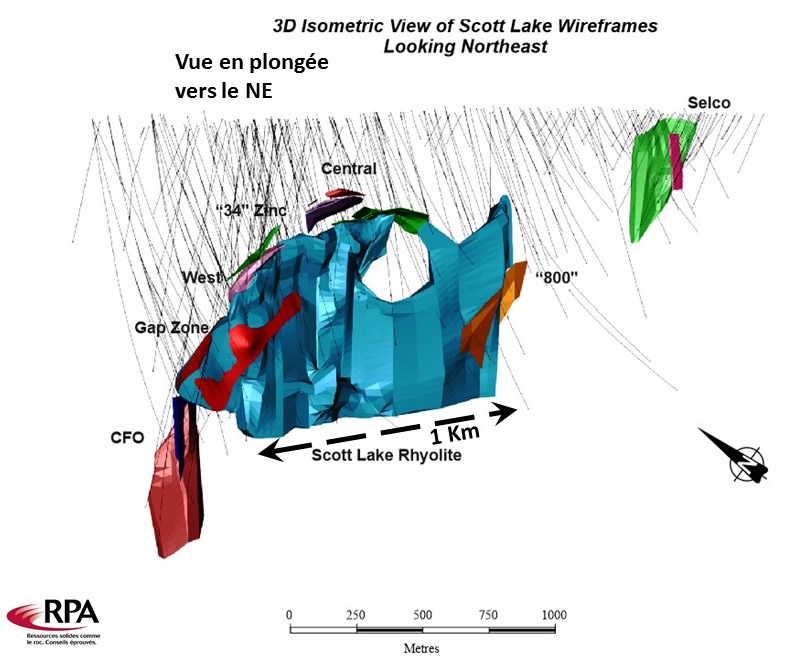

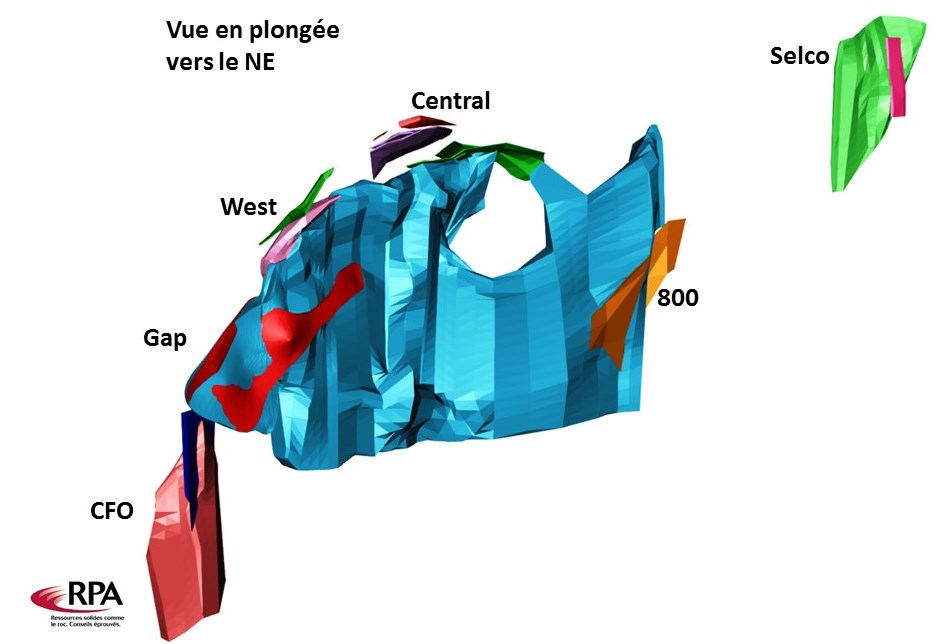

The project has seen considerable exploration activity in the mid 70's and in the late 80's following the discovery by Selco of a small VMS deposit. During the late 80’s, two additional massive sulphide lenses were discovered by Thundermin (Central and West Lenses). Since 2006, Cogitore discovered four new massive sulphide lenses (“800 Lens”, “CFO Lens”, “34 Zinc zone” and “SC-30 Lens”) and added considerably to the Central and West Lenses and to associated stringer sulphide envelopes. In 2015 Yorbeau discovered the new “Gap Lens” which was drilled until late 2016.

This culminated in a 2017 resource estimate by Roscoe Postle Associates (“RPA”) as follows:

| Category | Tonnes | %Cu | %Zn | g/t Au | g/t Ag |

|---|---|---|---|---|---|

| Indicated | 3,557,000 | 0.95 | 4.17 | 0.2 | 37 |

| Inferred | 14,281,000 | 0.78 | 3.19 | 0.2 | 22 |

1. CIM definitions of Mineral Resources were applied.

2. Resources are reported with NSR cut-offs of C$100/t for massive sulphide lenses, and C$65/t for stringer zones.

3. Parameters used by RPA for NSR determination include

a. Exchange rate of US$0.80=C$1.00, and

b. The following metal prices:

copper: US$3.25/lb,

zinc: US$1.20/lb,

gold: US$1,500/oz, and

silver: US$22/oz.

Mineral Resources at Scott may also be classified by style of mineralization as follows:

| mineralization style | Category | Tonnes | %Cu | %Zn | g/t Au | g/t Ag |

|---|---|---|---|---|---|---|

| massive sulphides | Indicated | 1,183,000 | 1.28 | 8.04 | 0.27 | 50.7 |

| stringer sulphides | Indicated | 2,385,000 | 0.78 | 2.25 | 0.19 | 30.5 |

| Sub-total | Indicated | 3,568,000 | 0.95 | 4.17 | 0.22 | 37.2 |

| massive sulphides | Inferred | 5 ,814,000 | 0.65 | 6.57 | 0.32 | 27.1 |

| stringer sulphides | Inferred | 8,467,000 | 0.87 | 1.37 | 0.16 | 19.0 |

| Sub-total | Inferred | 14 ,281,000 | 0.78 | 3.49 | 0.23 | 22.3 |

Contained (''in-situ'') metals in the above resources are as follows:

- copper: 320 million pounds

- zinc: 1.4 billion pounds

- silver: 14.5 million ounces

With updated resources of nearly 18 Million tonnes, a preliminary Economic Assessment was completed by RPA in late 2017. Under the base case PEA the Scott mineralized material is fed to a new 2,500 tonne-per-day concentrator plant located at the mine site. Results indicate positive economics with net revenues of nearly $2 billion, a pre-production capital expenditure of $215 million, a net pre-tax cash flow of $519 million, an Internal Rate of Return (“IRR”) of 16.6%, a pre-tax Net Present Value (“NPV”) of $146 million at an 8% discount rate, and a mine life of 15 years.

Tables 1, 2 and 3 show summaries of LOM estimated project.

Table 1 - Summary

| Net Sales LOM (NSR) | $1.98 milliard |

| Net Cash Flow | Flux avant impôt de $519.2 million |

| IRR | Pre-tax IRR of 16.5% with a 6-year payback |

| NPV | Pre-tax NPV(8%) of $144.0 million |

| Production Costs | Life of mine (“LOM”) Opex Costs of $89.02/tonne milled (includes mining, milling, G&A and Environmental) |

| Capex | Pre-production capital of $215.47 million, Sustaining capital cost of $113.2 million |

| Mine Life | Planned mine life of 15 years |

| Mill Feed | 12,024,000 tonnes at 0.8% Cu, 4.1% Zn, 26.6 g/t Ag and 0.24 g/t Au |

| Mill Recoveries | Average LOM recoveries: Zn: 87% , Cu: 85% Ag: 45% (in Cu concentrate) Au: 63% (in Cu concentrate) |

Table 2 - Operating Costs

| ($/t milled) | |

|---|---|

| Mining | 54.14 |

| Processing | 27.49 |

| General & Administration | 7.40 |

| TOTAL | 89.02 |

Table 3 - Pre-Production Capital Costs

| $(millions) |

|

|---|---|

| Mining | 52.58 |

| Processing | 60.00 |

| Infrastructure | 15.78 |

| Tailings | 4.65 |

| Sub Total | 133.01 |

| EPCM* | 46.55 |

| Contingency | 35.92 |

| TOTAL | 215.47 |

*EPCM: Engineering, Procurement, Construction, Management

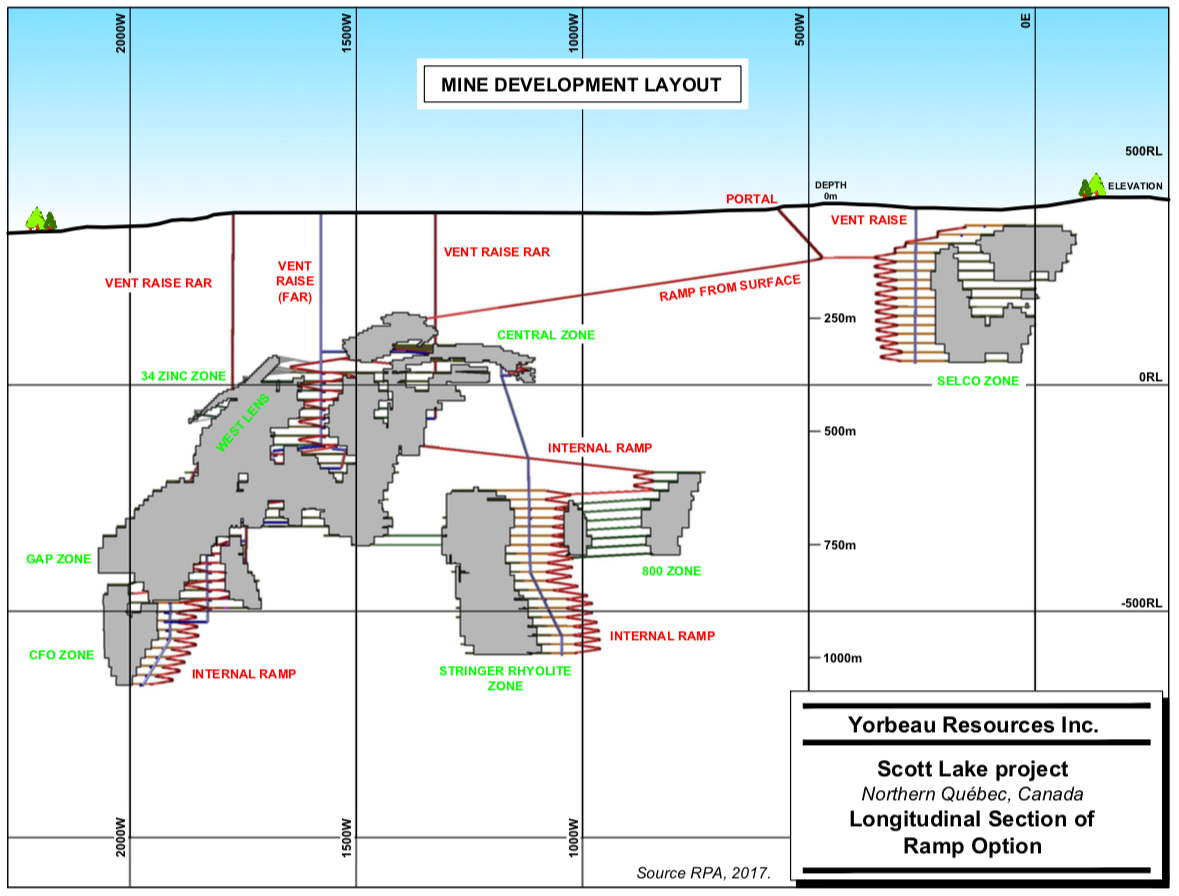

MINING AND DEVELOPMENT

The Scott Project would take approximately two to three years of initial development to prepare the mine for production.

Mining during the LOM will include 50% mineralized material from Longitudinal LH stopes, 26% from Transverse LH stopes, 11% from Cut and Fill stopes, and 13% from development.

The Stringer type mineralization will be mined using the Longitudinal stoping method and thus represents a large portion of the production profile.

PROCESSING

A concentrator would have to be built on site and the mill production mirrors the mine production. The mill feed would produce copper and zinc concentrates assumed to be commercially viable. Mill recoveries for the concentrates based on early metallurgical test work are 87% for zinc and 85% for copper. Precious metal recoveries in the copper concentrate are respectively 45% for silver and 63% for gold.

RECOMMENDATIONS

Among several recommendations made by RPA, the following are of note :

- The Study is based in part on Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them. Therefore, additional in-fill diamond drilling to bring Inferred Resources to the Indicated category is required before further economic studies are considered. Given the level of accuracy needed for the drilling, an underground exploration program may have to be considered.

- An underground exploration program, involving a ramp and drill accesses, would provide a head start on mine development, with a positive impact on project economics.

- Estimated mill recoveries for the concentrates are based on early metallurgical test work, and additional testing of the massive sulphide mineralization and the stringer mineralization independent of each other are required to adequately fully understand the metallurgical response during processing of both types of mineralized material for the life of the mine and to obtain marketable concentrate products.

Yorbeau Management believes that the results of the PEA study provide a strong, initial foundation for eventual development of a new mine in the Chibougamau camp. The ideal location of the project in a region already blessed with all necessary infrastructure has led to maintaining estimates of infrastructure capital costs to a very low level when compared to similar zinc projects. The horizontal widths and favorable geometry of the mineralized zones support the use of low cost long hole mining methods which had a big positive impact on the results of the study. Yorbeau is now in a position to evaluate a number of options to develop the Scott deposit.